Founder Turnaround Talk

I was watching a recent news report on CNN and a particular story caught my eye. Shoppers are being encouraged to begin their festive shopping now and that they need to have at least four alternatives. Apparently, the Covid-19 Pandemic is still wreaking havoc on supply chains despite the fact that the US and most of Europe are mostly fully vaccinated and are seriously pushing to return their economies to pre-pandemic levels of economic activity.

Supply chain has proven to be the biggest challenge of the pandemic. This has been discussed at length by Robin Nicholson; his articles on the topic can be found in the Special Features Archive section on the Turnaround Talk website.

One of the biggest issues when it comes to supply chain is when the world will return to normal. There was some hope that this would be achieved sooner rather than later. However recent reports suggest that business owners should not breathe a sigh of relief just yet.

The Power Crunch

At the high of Eskom’s loadshedding campaigns in 2008 and 2020, the power utility asked the mining industry, South Africa’s largest energy consumer, to decrease its production output by as much as 40% as the utility struggled to find grid capacity to keep the lights on. A similar request was given to industrial manufacturers.

It seems as if China is now experiencing an energy crisis of its own. An article by the Daily Maverick points out that China’s energy crisis is shaping up as the latest shock to global supply chains as factories in the world’s biggest exporter are forced to conserve energy by curbing production.

Local governments are ordering the power cuts as they try to avoid missing targets for reducing energy and emissions intensity, while some are facing an actual lack of electricity.

The disruption comes as producers and shippers race to meet demand for everything from clothing to toys for the year-end holiday shopping season, grappling with supply lines that have been upended by soaring raw material costs, long delays at ports and shortages of shipping containers.

The article adds that Chinese manufacturers warn that strict measures to cut electricity use will slash output in economic powerhouses like Jiangsu, Zhejiang and Guangdong provinces — which together account for almost a third of the nation’s gross domestic product — and possibly drive-up prices.

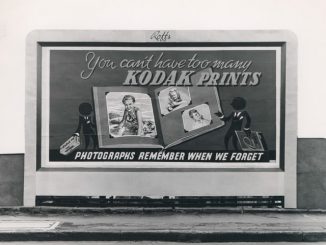

Photo By: CNN Business

Port disruptions

The article points out that the power problems come after recent port disruptions in China rippled across global supply chains. Part of Ningbo port, one of the world’s busiest, was idled for weeks last month following a Covid outbreak, while Yantian port in Shenzhen was shut in May.

The energy crunch will weigh on China’s economy at a time when it’s already slowing because of factors such as stringent virus control measures and tighter restrictions to rein in the property market.

“Global markets will feel the pinch of a shortage of supply from textiles, toys to machine parts,” said Lu Ting, chief China economist at Nomura Holdings Inc in Hong Kong. “The hottest topic about China will very soon shift from Evergrande to Power Crunch.”

Considering how dependent the rest of the world is on Chinese imports, what impact will this have on recovering SA companies?

The British energy crisis

One of the challenges that South Africa faced during the July unrest was that fuel (petrol and diesel) was hard to come by.

A similar energy crisis is being felt in the UK. The difference is that it is not being driven by civil unrest, it is being driven by a shortage of truck drivers.

An article by CNN points out that there are a few important things to note about the UK Energy Crisis.

Things are finally getting better

The article points out that there are now signs that shortages at the pumps are easing. The Petrol Retailers Association, which represents independent fuel suppliers, said on 22 September that about 27% of the 5 450 service stations it monitors were without fuel, down from 37% on 21 September and 66% earlier during that week.

“I think in the next couple of days people will see some soldiers driving the tanker fleet,” UK Business Secretary Kwasi Kwarteng told reporters on 22 September. “The last few days have been difficult,” he admitted. “We’ve seen large queues, but I think the situation is stabilizing.”

There’s actually plenty of fuel

The CNN article points out that oil companies including British Petroleum (BP), Royal Dutch Shell (RDSA) and Exxon Mobil (XOM) said in a statement that there is plenty of fuel at UK refineries and terminals.

The article adds that suppliers couldn’t get enough of it to service stations for two reasons:

First, there is a shortage of tanker drivers in the United Kingdom. That was underscored last week when BP was forced to temporarily close some of its stations for the second time in as many months because there weren’t enough drivers.

The second problem: British drivers reacted to the BP closures by rushing to buy gasoline, emptying many of the country’s 8,380 service stations.

Brexit deserves some blame

The article points out that the shortage of truck drivers in the United Kingdom goes back years, but it has been exacerbated recently by the pandemic, which delayed the issue of new licenses, and Brexit, which resulted in tens of thousands of EU nationals leaving trucking jobs and other occupations in Britain.

Photo By: Getty Images

Since the start of this year, new post-Brexit immigration rules have made it even harder for many of them to return.

The article adds that, according to the Road Haulage Association, the country is short of around 100 000 truck drivers. In August, the UK government said that most of the solutions to the crisis would be driven by employers offering better pay and conditions, and that it did not want to rely on workers from outside Britain.

The article points out that Prime Minister Boris Johnson was forced into a U-turn last weekend when he agreed to issue temporary visas for 5 000 more truck drivers and 5 500 poultry workers to help process Christmas turkeys. But he signalled that a further relaxation of immigration laws is unlikely.

“What I don’t think that people in this country want to do is fix all our problems with uncontrolled immigration,” he said.

South African exports to the UK are significant. What does this energy crisis mean for SA exporters? Vinpro has already pointed out that the export market is the only one that is sustaining the industry at a time when another booze ban is just one Presidential announcement away.

What impact does this have on South Africa?

There is a modern proverb which says: when China sneezes, the rest of the world catches a cold. This is certainly true when it comes to the electricity crisis.

China is one of the largest exporters in the world. South African retailers will be desperate to take advantage of the festive season shopping sprees that normally occur at the end of the year and will want their shelves full of products that are in demand. These are mainly made up of toys and electronics which are mostly shipped out of China.

For the automotive industry. The Chinese Power Crunch couldn’t have come at a worse time. The industry is desperately trying to overcome a microchip shortage which will only get worse if there are no answers to the Power Crunch situation.

The UK is one of our major export partners. There are already reports that the Brexit decision had not only led to shortages of certain food items, but it has made the cost of living sky rocket. If the energy crisis worsens, attention will be paid to mobilising Britain’s existing truck drivers to resolve that issue. This means that any export business to the UK will either be slowed down or delayed.

What does this mean for BRPs? Companies may find themselves in need of advice on how to diversify their business models so that they are not solely dependent on Chinese imports or UK exports. The mobilisation of BRPs may be towards providing advice on business turnarounds before these companies become distressed.