Founder Turnaround Talk

In the past few weeks, we have focused on the economic response to the Covid-19 Pandemic. We have shown that there is increased economic activity around the world. This is mainly coming from developed markets and is being driven by effective vaccination programmes and government support in developed economies.

The situation in South Africa is dire to say the least. One of the biggest indicators that a country is growing their economy is the level of liquidations. Recent statistics from Statistics South Africa (Stats SA) makes for poor reading which will no doubt only get worse once we determine the economic impact of Eskom’s latest round of load shedding.

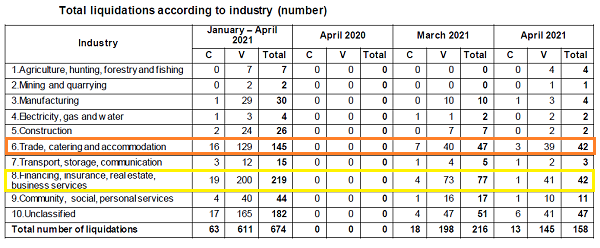

The following information is based off the Stats SA release on liquidations as of April 2021.

A heavy period

According to the Stats SA release, the total number of liquidations for April 2021 was 158. This followed zero liquidations in April 2020; however, there were no liquidations reported by the Companies and Intellectual Property Commission (CIPC) in April 2020 due to the COVID-19 lockdown.

The Stats SA report indicated that an increase of 78,6% was recorded for the period February 2021 to April 2021 compared with the same period in 2020. Additionally, the total number of liquidations increased by 55,3% in the first four months of 2021 compared with the first four months of 2020.

There is a glimmer of hope. If we look at the trend of reported liquidations between January 2011 and January 2021, we can see that – despite the current increases – the trend is moving downwards.

The obvious caveat to this will be the impact of Covid-19 and the number of liquidations that follow on from that. This kind of disruption has not been experienced before and unlike developed economies, there is very little government support for businesses that have been impacted by Covid. If there is support, it is not readily accessible.

The usual suspects

In an effort to try and manage the spread of Covid-19, Government imposed a hard lockdown on 24 March 2020. As the infection rate decreased, Government started to reopen the economy in stages. Companies were only allowed to resume trade according to the Covid-19 response level that they fell under.

The impact of this has been telling. Some industries were impacted worse than others. According to the Stats SA release, the industry sector that was worst affected was the finance industry which includes finance houses, insurers, real-estate companies, and business services. This was followed by catering and accommodation companies.

Focusing on the finance industry (highlighted in yellow), we see that there were 42 liquidations in April 2021. The impact on this industry is worse than anticipated as Stats SA reported that there were 77 liquidations in March 2021. Seventy-three of these (March 2021) were voluntary while only four were compulsory.

If we look at the trend from January to April 2021, we can appreciate the kind of disruption companies have faced during this period. If we look at the liquidations in March and April 2021, we see that there were 119 liquidations. If we look at the period from January 2021 to April 2021, we see that there were 219 liquidations in this sector. This means that in January and February 2021 there were 100 liquidations.

Focusing on catering and accommodation (highlighted in orange), we see that there were 42 liquidations in April 2021. This closely followed March’s figures where there were 47 liquidations. The number of voluntary liquidations over compulsory liquidations once again favoured voluntary liquidations.

If we look at the liquidations in March and April 2021, we see that there were 89 liquidations. If we look at the period from January 2021 to April 2021, we see that there were 145 liquidations in this sector. This means that in January and February 2021 there were 56 liquidations.

Photo By: Lucian Potlog via Pexels

Reasons for disruption

The reasons behind the number of liquidations could be numerous. However, the Covid-19 Pandemic stands out.

When it comes to the financial sector, global statistics show that during economic recessions, insurance is the first item to be cut from the budget. While larger insurers such as Santam, Hollard and Discovery may have enough assets undermanagement to negate this, smaller (speciality) insurers would not be so fortunate.

When it comes to catering and accommodation, unfortunately we don’t have statistics regarding liquidations in 2020 which may or may not have been high. The hard lockdown imposed by government restricted movement around the country and put a complete halt on conferences and trade shows. Companies in this sector may have been able to survive on savings, but with an indefinite pause in the conference and trade show sector (and the growing preference to moving towards virtual events) catering and accommodation companies will now start running out of savings.

The above disruption comes down to the fact that there is decreased discretionary spending and an attention shift. Patrons are prioritising discretionary spending on essential items as well as healthcare over taking a mid-week break to a hotel, resort or game park.

Entertainment definitely faced disruption. Streaming services such as Netflix, Showmax and Amazon Prime absorbed the market share that would traditionally have gone to cinemas. Fast food outlets absorbed some of the market share that would have traditionally gone to restaurants; however, most restaurants now offer take out options and appear on delivery services such as Mr Delivery and Uber Eats.

Slimmer versions

One of the industries that seems to have avoided the worst effects of the Pandemic is health and fitness.

Gyms in particular have managed to survive. It seems strange as these companies were one of the last to reopen their doors; however, statistics show that the average person picked up 5 kg during lockdown. Gyms saw their membership increase significantly in the immediate months following reopening as the public looks to regain their fitness.

This is something that BRPs need to consider, putting distressed companies on a weight loss programme where they work to transform themselves into slimmer versions of what they were by cutting loss making products and services and focusing on what makes the company money. There are a number of options at your disposal, choose wisely bearing in mind the shift in discretionary spending and the priorities associated with it.

The full report can be accessed here.