Director: ReVive Advisory & Turnaround

Over the past few weeks, we have been looking at the South African Broadcasting Association (SABC) and the possible models that it can follow to ensure that it has a sustainable future.

SABC is not underperforming in a thriving sector; The whole sector is facing difficulties in all media types but all broadcasters are facing value-based discussions predicated on digitisation’s impact on their business

Last week, we began the discussion on an investigation that the UK has done, and the consensus was that there are massive changes that broadcasters have to deal with. Today, we will take a closer look at how to fund changing business models.

Creating a sustainable future

The report (hyperlinked above) points out what a sustainable future for Channel 4 might look like. Channel 4 is an integral part of the British public service broadcasting system. It contributes to the UK’s creative economy and creates fun, daring, and provocative programming enjoyed by a broad range of audiences. Channel 4 has done an excellent job in delivering its founding purposes – providing greater choice for audiences, and supporting the British production sector. Forty years on, independent production in the UK is now booming, with companies increasingly less reliant on Channel 4 for commissions. Choice is no longer a problem in a world of smart TVs and streaming sticks, catch-up and on-demand content.

As is the case for other public service broadcasters, Channel 4 faces growing competition for audiences, programmes and talent from new global video-on-demand providers with greater spending power.

Audiences are increasingly likely to consume content on non-linear platforms such as video-on-demand services. Whilst overall daily viewing time is increasing, rising from 4 hours 49 minutes in 2017 to 5 hours 40 minutes in 2020, linear TV’s share of total viewing fell from 74% in 2017 (3 hours 33 minutes) to 61% in 2020 (3 hours 27 minutes). At the same time, subscription video-on-demand services’ share of total video increased from 6% in 2017 (18 minutes) to 19% in 2020 (1 hour 5 minutes).

The report adds that, in addition, the TV advertising market has changed significantly, with spending on linear TV advertising, which constituted 74% of Channel 4’s revenue in 2020, declining substantially in the last decade in favour of digital channels. Linear TV advertising revenues fell 31% sector-wide between 2015 and 2020.

In the Government’s view, Channel 4’s public ownership model is constraining its ability to respond to the challenges and opportunities of this changing broadcasting market in the long term. That is why the British Government consulted on the best means of ensuring its future success and sustainability as a public service broadcaster. It is our conclusion that now is the right time for the Government to pursue a change of ownership of Channel 4. The British Government needs to ensure that Channel 4 can continue to thrive and grow its impact for years to come as part of the wider public service broadcasting ecology in the UK.

Image By: Supplied

Unique turning point

The report points out that Brittain is at a unique turning point. Channel 4 has fulfilled its original mission, and now it is the Government’s responsibility to take a long-term view. the UK Government believes that the investment in content and technology needed to succeed in this rapidly changing media landscape will be delivered at a greater scale and with a greater pace under private ownership, supported by private-sector capital, rather than asking the taxpayer to bear the associated risk. Brittain has the opportunity to make Channel 4 bigger and better without losing what makes it so distinctive.

Channel 4 is and will remain a public service broadcaster, just like other successful public service broadcasters – ITV, STV, Channel 5 – that are already privately owned. A change of Channel 4’s ownership forms part of the Government’s wider broadcasting reforms to support all public service broadcasters into the future. Channel 4 itself has set out that it both wants and needs to grow. In order to achieve it, Channel 4 will need to invest and innovate more and faster. As for all other public sector broadcasters, it needs to be able to generate and own its own content. Having greater access to capital and the ability to produce and sell its own content (currently a licence restriction) will give Channel 4 the best range of tools to accelerate and unleash its potential.

The report adds that this can allow it to create more great programming made by people who live and work across the UK. It can allow it to invest more in technology to make watching Channel 4 content easier, faster and more engaging. It can enable Channel 4 to think genuinely big in terms of the next evolution of its business model and strategy to help it lead the way in defining ‘what’s next’ in the global TV market.

A pure funding issue

The report points out that the move to privatise Channel 4 in the future is a pure funding issue.

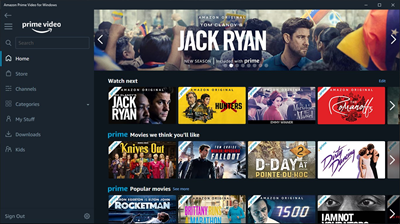

Independent production sector revenues have grown from £500 million in 1995 to £2.9 billion in 2020, whilst the contribution of public service broadcaster commissions to sector revenue fell from 58% in 2010 to 41% in 2020, due in large part to the growth of international commissioning revenues. Primarily Netflix and Amazon Prime.

Of the £2.9 billion sector revenues in 2020, public service broadcasters accounted for £1.2 billion, with Channel 4 spending £210 million on external commissions, less than each of the BBC (£508 million) and ITV (£356 million), who both have their own in-house production studios. Whilst Channel 4, therefore, still plays an important role, the sector is increasingly benefitting from commissions from other sources and can continue to prosper without the publisher broadcaster restriction on Channel 4.

Image By: Microsoft Store

Unsuitable

It’s worth noting that while the UK Government sees privatisation as the future for Channel 4, this approach may not be suitable for the SABC. The SABC’s unique circumstances and the demographics it serves require a different approach.

The demographics of South Africa call for a free-to-air public service broadcaster. The majority of the SABC’s target audience cannot afford to pay for this service; this would leave them without access to the news and current affairs, education and documentary programming for which the SABC has become famous.

However, the SABC embraces a hybrid model where it caters for those who cannot afford this service and those who can. Depending on service coverage and broadband availability the majority of entertainment and news is being consumed over smart devices and streaming services. I include DStv in a streaming service although they are still evolving this model themselves.

One of the reasons why streaming services such as Netflix and Disney+ are so popular is that they have a massive library of content that can be consumed at the user’s leisure. The SABC should invest significantly in its SABC+ app and move its treasure trove of content onto it.

The Channel 4 discussion points to some harsh economic realities facing South African Media owners and the SABC:

- The Competition for viewers is global and fragmented by consumer choice

- The fragmentation is driven by technology and is unavoidable. (SABC needs to be ubiquitous in its distribution and not reliant on a single platform or service provider)

- Our content production market needs support from the whole broadcasting ecology and the regulator. The cost of data is still too high. (Media employment multiplier is still one of the highest of any sector)

- The SABC needs a comprehensive restructure of its media offering and production facilities. It must redirect its spending to content creation that its audiences will demand.(Does it need large overheads associated with property ownership tied to obsolete infrastructures and technologies or more flexible working environments and more spent of the creative elements of the business.)

- Agility, flexibility and responsive to the audience is better suited to a media world dominated by choice. The SABC needs to unlock it legacy content and ignite SA creatives and use their energy to drive the Public Service broadcaster forward.

A old friend of mine Peter Matlare drove home one message that remains fixed in my mind. “Media is the ultimate democracy, one twist of the tuner, one push of the remote, one click of the phone and the consumer will find the programming they want. The broadcaster’s mission must be to provide it”