Founder Turnaround Talk

Many articles have been written over the course of the year about the level of disruption that companies hare currently facing.

It is therefore no surprise that Deloitte pointed out in its latest report (on the current state of the profession) that we will soon see the rise of the role of Chief Restructuring Officers (CRO) and the enormous mandate that they will have. This will inevitably include keeping the doors open and the wheels of industry turning. If we delve deeper into this mandate, it means that the yardstick that these executives will be measured by is: has the company avoided financial distress?

At a virtual event that was hosted earlier in the year, Dr Wesley Rosslyn-Smith (a Senior Lecturer at the University of Pretoria) described business rescue as a triage for a distressed business. This means that the business turnaround process is the final stage is what is a radical structural change within a business.

This puts a lot of pressure on companies and takes up a lot of time and resources that management will want to avoid at all costs. One would therefore assume that CROs, and companies who are on the brink of distress, will gravitate towards informal restructuring. We have seen the media reports of the country’s big-name companies that went into business rescue over the past two years. This is merely a fraction of the actual activity in the profession. But the question is, are BRPs making a difference?

Liquidations down, insolvencies up

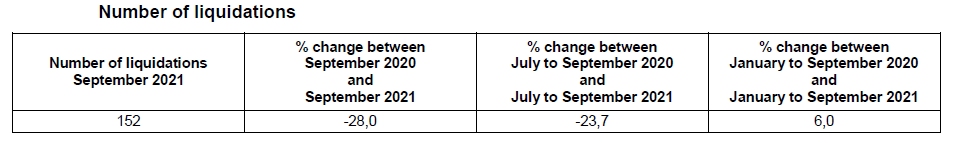

Indications are that BRPs are making a difference. A recent report by Statistics South Africa points out that the total number of liquidations decreased by 23,7% in the third quarter of 2021 compared with the third quarter of 2020. A year-on-year decrease of 28% was recorded in September 2021.

The report adds that voluntary liquidations decreased by 46 cases and compulsory liquidations decreased by 13 cases.

The total number of liquidations increased by 6% in the first nine months of 2021 compared with the first nine months of 2020.

However, the estimated number of insolvencies increased by 123,1% in the three months ended August 2021 compared with the three months ended August 2020. A 76,8% increase was estimated in August 2021 compared with August 2020.

Seasonally adjusted insolvencies decreased by 15,9% in August 2021 compared with July 2021. This followed month-on-month changes of -15,8% in July 2021 and 234,1% in June 2021.

Covid hasn’t been a major game changer

When one looks at the disruption that many companies are currently facing, one would assume that the Covid-19 Pandemic would have had a significant impact on the number of liquidations.

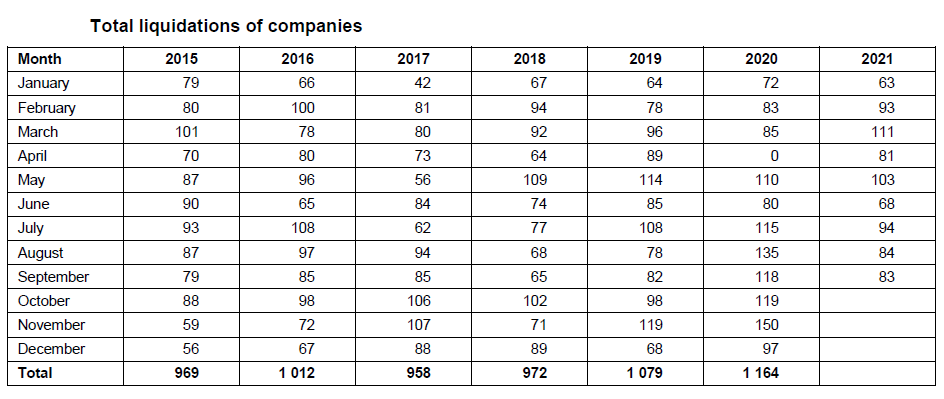

However, if one looks at the statistics from 2015 to 2020, we see that while the number of liquidations have been steadily increasing, there is no significant jump. The Stats SA report points out that there were 969 liquidations in 2015. If we fast forward to 2020, there were only 1 164 liquidations. That’s only an increase of 195 liquidations which is amazing considering what companies had to deal with in 2020. Looking at the available numbers for 2021, there will be an increase because the Companies and Intellectual Property Commission (CIPC) didn’t record any liquidations in April last year while there were 81 liquidations in April this year.

The usual suspects

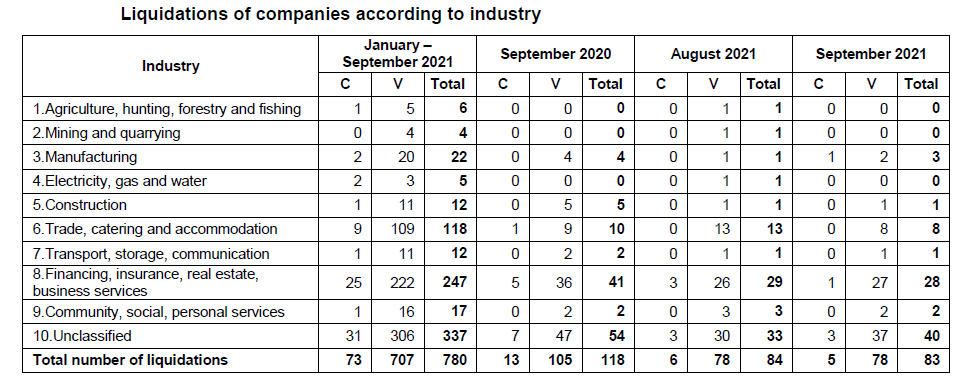

If we look at the industries that have had the most liquidations, we see that they are companies that have been significantly impacted by lockdowns that are associated with the Covid-19 Pandemic.

Financing, insurance, real estate, business services had the most liquidations. This is not surprising and is an indicator that discretionary spending is under pressure. When this is the case, items such as insurance are the first to be excluded from any budget.

Trade, catering and accommodation is under significant pressure and saw 118 liquidations between January and September 2021. This is an indication that the global supply chain crisis is significantly impacting the retail sector and that the travel bans, and restrictions associated with Covid-19 variants are massive challenges that companies need to overcome. This may change again in December following the recent travel bans imposed by international countries.

Going forward

If we look at the five-year trend – 2015 to 2020 – we see that despite Covid-19, there has not been much of a change in the number of liquidations.

Does that mean that we will see the same this year? No. While 2020 was a year of strict lockdowns, the July civil unrest was a major disrupter this year and has placed many companies is a tough situation. There were 94 liquidations in July; however, many companies may have been able to weather the immediate disruption caused by the unrest, this may change as the compounded impacts of the unrest becomes a bridge to difficult to cross.

The Covid-19 Pandemic is showing no signs of abating. It will be around for a long period of time. Depending on the vaccination rate in South Africa, we may be able to avoid further waves of the virus. This is important because avoiding lockdowns means that economic activity will continue. Companies that are able to adjust their business models and are open to informal restructuring when they discover that they are in trouble, will be able to avoid liquidation. Those who cannot adapt and adopt new business models will find themselves in distress.

Are BRPs making a difference? One would assume that the numbers for 2021 will mostly track those from 2020. If we consider the fact that a lot of companies were placed in financial distress, and there was no significant jump in the number of liquidations in 2020 and 2021, then we can emphatically say that BRPs are making a difference and will continue to make a difference in the industry going forward.